When Andrew and I met I will say one of us was VERY money conscious and one of us was definitely not. Spoiler alert-I was not. But at the time we were in our 20s, not married, and kids were nowhere on the horizon. We were enjoying that DINK life (double income no kids). Of course, as we moved in together, got married, and wanted to buy a house we had to meet at a mutual understanding of our finances. Then we wanted kids and had to figure out how much it actually costs to raise two kids. Spoiler alert there: A LOT. I want to share with you some of the lessons we’ve learned, the tools we use, and the mistakes we’ve made so you can be more prepared than we were.

How Much It Actually Costs To Raise Two Kids

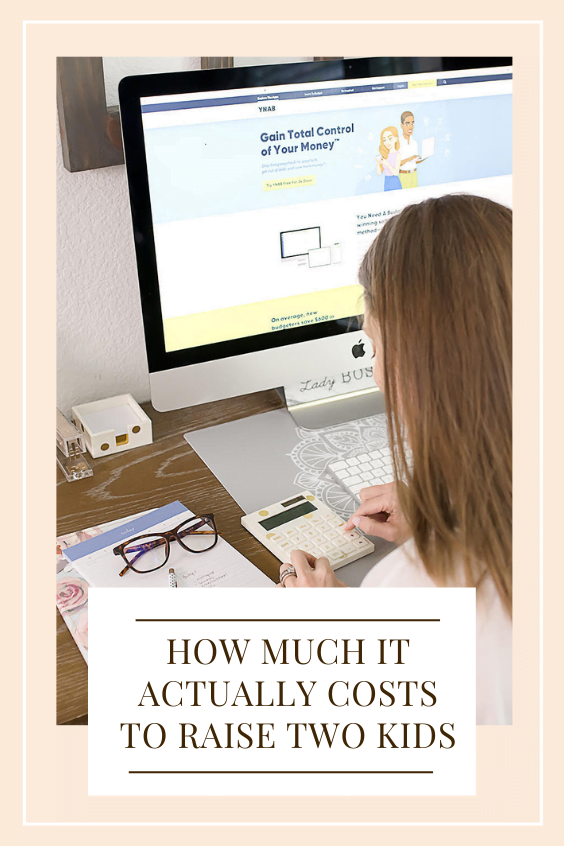

I don’t think I ever thought about all the little expenses that arise when you have kids. Not just clothes, food, and shelter but tuition, Dr bills, procedures, camps, childcare, toys, the list goes on and on. I really wish we had a tool like You Need A Budget before we had kids but thankfully we have it now. Every person, couple, and family has different goals. Maybe your goal is to not live paycheck to paycheck, maybe you want to save for your kid’s college, or maybe you want to take amazing vacations every year. Maybe it’s all of those! YNAB is an award-winning personal finance software and proven method to gain total control of your money and TRUST ME it works! YNAB teaches four simple rules that show you how to stop living paycheck-to-paycheck, get out of debt, and save more money so that you can spend it on the things that matter most to you, and who doesn’t want that?

So How Much Does It Really Cost To Raise Two Kids?

I feel like talking about money mostly brings people stress and very rarely joy. When I was pregnant I did a simple Google search for how much it costs to raise a child. It’s over $230,000! Times two and let’s just say I had several mini panic attacks. So when we sat down to learn all the wonderful ways of YNAB we had a few goals in mind: provide our kids with everything they need plus mostly want, save for their future (and ours), and make sure they had a life full of wonderful experiences.

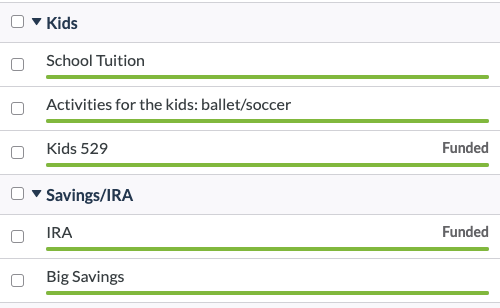

(Snapshot of 2 sections of our budget- I have the kids sectioned off in their own area)

YNAB has four main rules:

- Give Every Dollar a Job. Know exactly how you want to spend the money you have available – and only the money you have right now – before you spend a dime. This helps ensure that you have money for the things that matter most to you—whatever it might be. Think of your money as working for you and don’t let it sit around idle.

- Embrace Your True Expenses. Figure out what you really spend and treat those infrequent expenses (like twice-a-year car insurance or replacing your laptop every two years) like monthly expenses in your monthly budget. Breaking big or uncommon expenses down means you won’t be surprised by them.

- Roll With the Punches. Accept that things change and your budget needs to be flexible. You won’t spend the same amount on all categories every month, so be prepared to move money around. Moving money around doesn’t mean you are budgeting wrong, it means you are actually budgeting!

- Age Your Money. Break the paycheck to paycheck cycle by aiming to reach the point of using the money you earned last month to pay this month’s expenses. This margin will create more peace of mind than you can even imagine

Can you even imagine the actual JOY money could bring you? The times that you think about money and it brings you a smile, not sheer panic? That’s how we feel now! There were sooooo many years we thought we were budget correctly, saving correctly, etc. But in reality, we were not. We used YNAB to help us figure out where our money was going, exactly how much we were spending, and how to better save. Now we are able to happily look at our budget, expenses, and accounts and not feel like we are making huge mistakes.

What we really love about YNAB is that there is NO PRESSURE! It’s not a one size fits all plan and things are so flexible and adjustable that you don’t feel so bogged down the way a lot of other budgeting software tools have you feel. Things change and adjust so much in life and with YNAB your budget does too. For example, I have in my budget that we get $250 a month for date nights. Well, there are times we don’t have date nights so it’s easy to move that $250 somewhere else like clothes for back to school or just into savings!

It can also seem a bit overwhelming at first and TRUST me I thought I could figure it out 1, 2, 3 but I ended up watching some of the videos and tutorials YNAB has which I highly recommend so you are getting the most out of it! It has a bit of a learning curve but once you get going it’s truly so easy and honesty a lot of fun!

Kids are expensive yes but that doesn’t have to limit you! With the right tools and approach you can save, budget, and live life to the fullest enjoying all the things you want to do with your family.

Try it free for 34-days (no credit card required) and see how You Need A Budget is so different from anything else you’ve tried before (spoiler alert: it works and you’ll love it!)

Did you know how much it actually costs to raise two kids? Have you tried You Need A Budget? Will you??

Thank you to You Need A Budget For Partnering on this post. All opinions are my own.

This sounds like a great plan! My husband and I do a lot of this already. We added up our yearly expenses for both personal and business and broke it down into months. We also have a separate bank account that we transfer into every month for our HOA fees. It’s a lot at once, but manageable when we do it bit by bit and have it all sitting there ready when that bill comes in January.

I think one of the best tips I’ve ever read on money is the idea of aging it. Using what you have now to pay for the expenses that you’ll have later.

Kids are not cheap! I have two of my own and they are a constant drain on finances. But with the right planning, you can find ways to save money and reduce these costs. I want to be able to retire eventually!

Give Every Dollar a Job – this is a must with or without kids. When you manage your expenses wisely, it helps protect you in the event of a financial emergency.

I really do need a budget so will check this out. We only have one child and that’s expensive enough!

This is an interesting article! Many people need guidelines for personal financial planning. Raising kids can be a challenge, but with forecasting, it’s great!

I have never heard of it before, but that software sounds really helpful for everyone to save their money.

Kids are expensive. I wasn’t sure how we were going to do it after the birth of our second. But you find a way. And exactly as you said. Every dollar counts. EVERY single one. You give great advice to new parents.

I actually don’t have any idea how much it costs to raise two kids, but because of your article, I am enlightened about it, and this would be very helpful in the future in case I plan for a family. Thanks for sharing this tool.

Oh wow, this is neat. I know we’re not budgeting correctly but I just don’t know how to make the adjustment. I’ll try this!

This post makes me reflects. I never really thought how much it cost me to raise my 2 girls.

I agree. We need to embrace our true expenses. Always have an allowance too for some extra. There will always be emergency and unforeseen expenses so always be ready for it. Set aside a realistic budget so you can plan accordingly.

Kids are so expensive! We do a lot of sports and music, and the tuition for those is so expensive. We know some people that don’t do any extracurriculars, so it really depends.

Having children really is a big expense, especially as they get older in age. The price goes up for everything! This is a great article to bring awareness to the cost of raising children.

This is interesting. I think YNAB is a smart family planning approach. Handling finances is definitely a hard task and it is always clever to have a guide like this to manage your finances wisely

Thank you for sharing